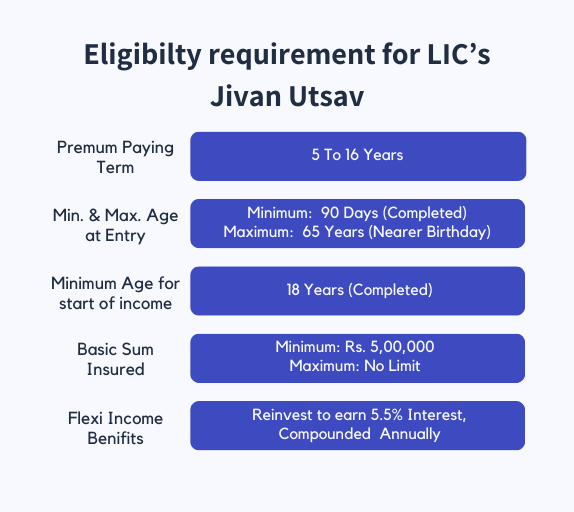

Limited Premium Paying Term 5 to 16 YearsEntry age: Minimum 91 days and Maximum 65 years.

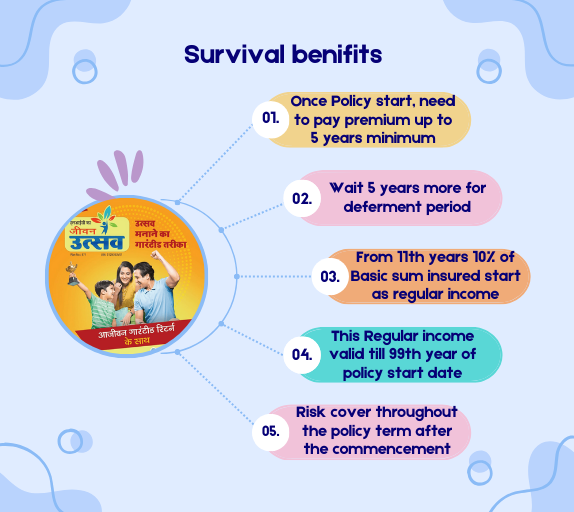

Guaranteed Regular Income benefits 10% of Basic Sum Assured shall be payable at the end of each policy year

Whole life insurance with limited premium paymentNon-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan.

LIC’s Jeevan Utsav is a Non-Linked, Non-Participating, Individual, Savings, Whole Life Insurance plan. This plan provides financial support to family incase of unfortunate death of Life Assured and survival benefits in the form of Regular Income Benefit or Flexi Income Benefit as per the option chosen for surviving policyholder.

Rider Benefit with LIC’s Jivan Utsav Plan

LIC Jeevan Utsav comes with 5 riders. Let’s discuss below each in detail!

01

LIC’s Accidental Death and Disability Benefit Rider.

The benefit cover under this rider shall be available before the policy anniversary on which the age nearer birthday of the life assured is 70 years…

02

LIC’s Accident Benefit Rider.

This rider can be opted for at any time under an in-force policy within the premium paying term of the Base plan provided the outstanding premium paying term of the Base plan as…

03

LIC’s New Term Assurance Rider.

This rider is available at inception of the policy only. The benefit cover under this rider shall be available for a term of 35 years or till the policy

anniversary on which the age nearer…

04

LIC’s Premium Waiver Benefit Rider.

Under an in-force policy, this rider can be opted for on the life of Proposer of the policy; at any time coinciding with the policy anniversary but within the premium paying…

05

LIC’s New Critical Illness Benefit Rider.

This rider is available at the inception of the policy only. The benefit cover under this rider shall be available for a term of 35 years or till the policy anniversary on which the age…

06

Option to take Death Benefit in Instalment.

This is an option to receive Death Benefit in instalments over the chosen period of 5 or 10 or 15 years instead of lump sum amount under an in-force as well as paid-up policy…

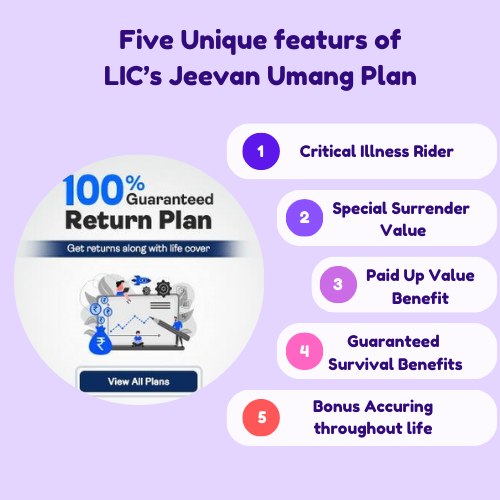

LIC Jeevan Umang Plan is a whole-life assurance plan, designed to offer a dual benefit of income and protection to your family in your absence. This plan provides yearly survival benefits from the end of the premium-paying period until maturity. It also offers a lump sum payout at maturity or in the event of the policyholder’s death during the policy term.

Eligibility Criteria for LIC’s Jeevan Umang Policy

The minimum entry age for the policyholder is 90 days, and the maximum entry age is 55 years. The maximum maturity age for the policyholder is 100 years. And the minimum sum assured under this plan is 2,00,000 and there is no maximum limit on the sum assured.

Read More

Premium Payment Option Available under LIC Jeevan Umang

The policyholder can choose to pay premiums yearly, half-yearly, quarterly, or monthly. The premium payment term for this plan is the same as the same as the policy term, which can be 15,20,25 or 30 years.

Read More

Advantages and disadvantage of the LIC Jeevan Umang Plan

The plan provides a guaranteed annual survival benefits(ASB) of 8% of the basic Sum assured after the premium payment term until the policy holder’s death or maturity. on maturity, the policy holder receives a lump sum payment of the basic sum assured. in case policyholder’s death, the nominee receives the sum assured along with any accrued bonuses(if any). There are no such disadvantages to the Jeevan Umang.

Read More

Policyholder take a loan against LIC Jeevan Umang Plan

Yes, The policyholder can take a loan against this plan after the policy acquires a surrender value, which usually happens after the premium payment term. the loan amount can be up to 90% of the surrender value, and the interest rate on the loan is decided by LIC from time to time.

Read More

Coverage against fatalities brough on by any Critical illnesses

Yes, This Plan will cover any natural deaths or health-related problems. The LIC Critical Illness Rider, which provides coverage for 15 critical Illness, is another option if you want comprehensive coverage.

Read More