Health Insurance Checklist

Here a list of important policy features and it should be clear before you take any health insurance policy. using following details you an idea about what to needs from a decent health insurance policy.

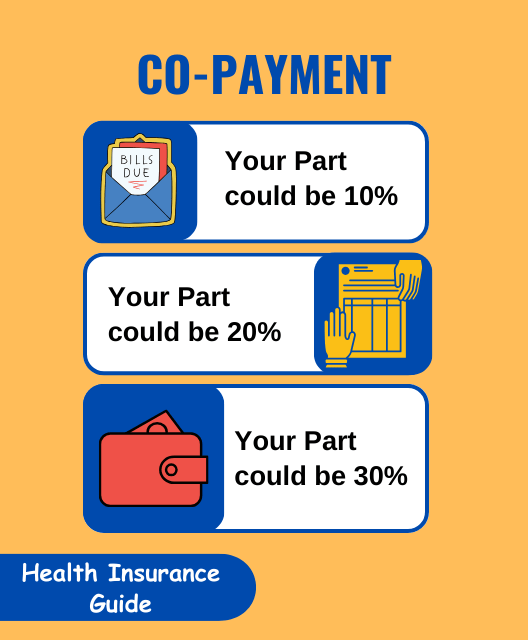

Don’t split bills with Insurer

Your health insurance policy may include a deductible clause. In this case, you are forced to pay a portion of the bill if you make a claim. This is called a deductible in health insurance.

It can be 10% of the hospital bill. It can also be 20%. Or even 30%. So it’s not necessarily the best solution to opt for a deductible, unless you have the option to choose an insurer.

Avoid sharing of bills

When choosing health insurance. Always avoid a deductible clause.

Lowest sharing if no other options

And if you have no other option, at least choose the deductible option.

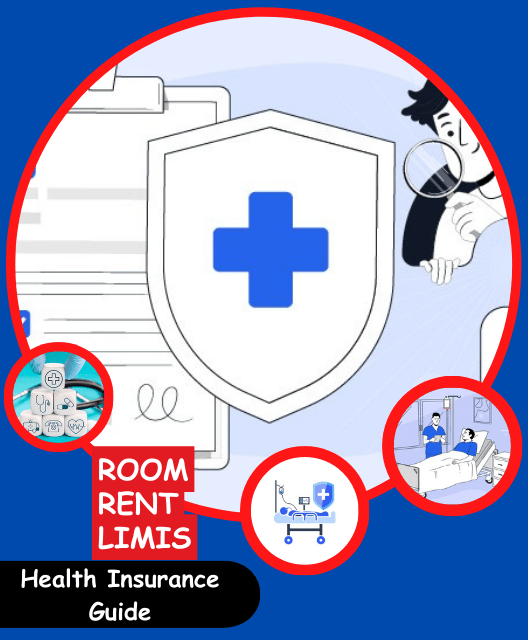

Restrictions on room rent

Usually, the cap on room rent is specified up to a certain percentage of the sum insured. For example, if the ceiling for room rent is 1 percent of the sum insured and the sum insured is 5,00,000 rupees, it means that the room rent in the policy is limited to 5,000 rupees.

Some insurers do not allow you to choose a room that you like. Instead, they have a limit on the room rent.

Extra Service Charge

And if you exceed that limit, you have to pay extra for every little service provided in the room, not just the rent.

Portion of bill leaved on you

You will end up paying a large portion of the bill. So opt for a policy that doesn’t have too many restrictions in this regard.

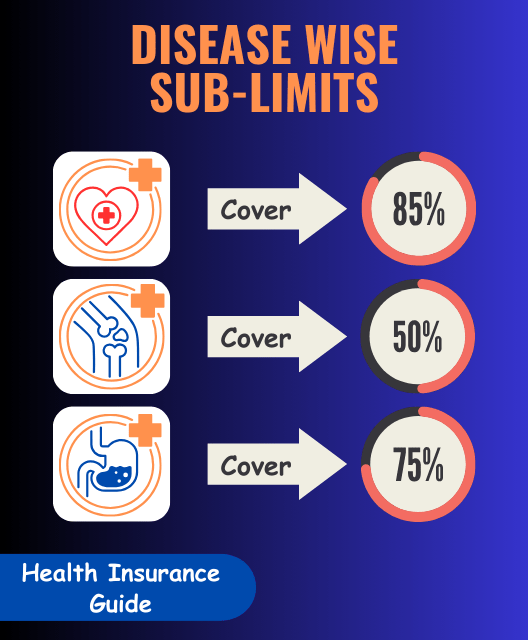

Check for Disease Wise Sub-limits

In some health insurance plans, any illness is covered up to a certain amount, depending on the age of the insured and the characteristics of the plan. This is when the insurer offers you comprehensive coverage for a small premium, but with limitations for each individual illness.

For example, in most insurance plans, cataract treatment is covered at 30,000 or 40,000 rupees for one eye, while the maximum coverage for both eyes is only 70,000 rupees, even if your sum insured is only 10 lakh. This is also the case for other diseases.

Fixed Amount coverage

The cap in health insurance is a % of the SI or a fixed amount set aside for the treatment of a particular condition

Extra cost

If this cap on treatment is exceeded, all additional charges billed must be paid by the policyholder.

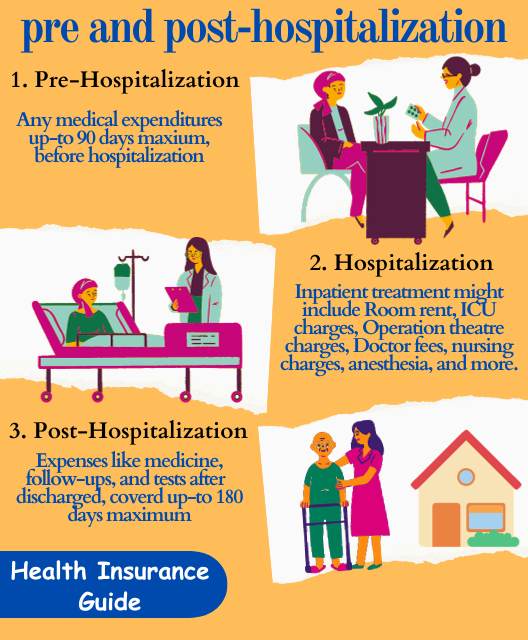

Pre and Post-hospitalization

No person immediately becomes very ill. In this case, you must be hospitalised. Before you are hospitalised, you will probably have to undergo a series of diagnostic tests, if you are really very sick, you will be hospitalised, otherwise not.

When you are discharged from the hospital, you have to take care of the medications. And these costs can increase. So it’s always best to choose a policy that covers pre- and post-hospital care. We know this feature as pre-hospitalization and post-hospitalization.

Pre-hospitalization Coverage

All medical expenses up to a maximum of 90 days before hospitalization

Post-hospitalization Coverage

Post-discharge expenses for medications, follow-ups and tests covered up to a maximum of 180 days.

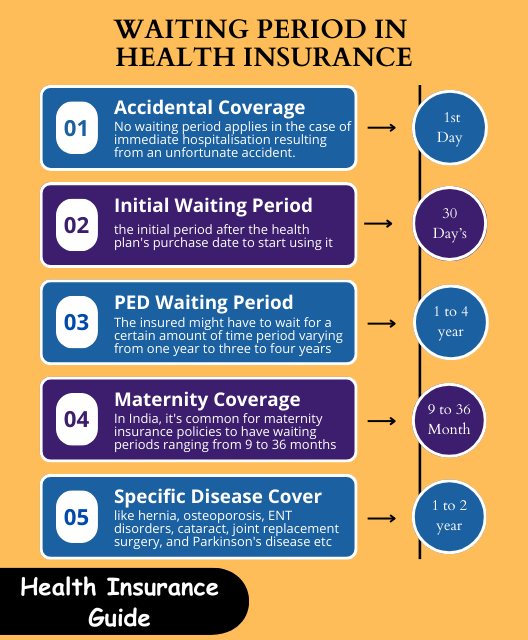

Seek a Lowest Waiting Period

If you purchase health insurance and have pre-existing conditions (e.g., diabetes, high blood pressure, or thyroid disease), you may have to live for a period of time before your insurer will cover claims based on these complications. You will have to wait.

Usually this is between 2 and 4 years, depending on the term of the policy. So it is always best to choose a policy where you do not have to wait too long.

Take Instant Cover

This feature provides you with comprehensive coverage for pre-existing conditions such as diabetes, asthma, hypertension and hyperlipidemia from day one.

Opt Minimum Waiting

Health insurance plans with a short waiting period for PED have a minimum term of 1 year. You can take advantage of this option by paying an additional premium.

Ask for restoration benefit

In a health insurance policy, the sum insured is fixed for which you pay a premium. This is valid for 1 year. Suppose that during your first hospitalization, the amount of your bill is equal to the sum insured. So, in this case, you are not left with any outstanding insurance amount.

And then after a few days another family member falls ill. Or you fall ill again yourself. But you have already used up the insurance coverage. The only thing that can help you is the reinstatement benefit, which is when your insurer reinstates your coverage every time you file a claim. If not every time, then maybe at least once… that’s possible.

Unlimited restoration of cover

100% of the sum insured is restored an unlimited number of times within an insurance year and can be used for all claims.

Normal Restoration benefit

With the Restoration Benefit, the sum insured under your health insurance policy can be restored once a year up to the maximum limit ASAP, if it is exhausted after a claim.

Other Features

Bonus in case you don’t make a claim

What if the insurer offers you additional coverage every year? Such an insurer will offer you some bonus coverage in your claim-free year. Some insurance policies offer very high bonus coverages. So it’s worth checking to see if your policy also offers these benefits.

For example: you have taken out a health insurance policy with a coverage of 5,00,000 rupees and your insurer offers you a bonus of 20% for each claim-free year. So, if you have not made any claims on the health insurance policy in the first year, your coverage amount would increase to Rs 6,00,000 rupee for the same premium.

NO Claim Bonus – Opt for health insurance with maximum NCB. If you do not use benefits, your coverage will increase up to a maximum for the same premium amount.

NCB Protection – Nowadays, some health insurance companies give a bonus even if you do not make a claim. This feature is called no-claims bonus protection.

Free health checkups every year

Most health insurance plans provide for annual or semi-annual screening, which is usually subject to a maximum amount that varies from health insurance company to health insurance company.

Health insurance screenings are useful for early detection of disease. Some examples are physical examination, blood pressure measurement, Pap test and laboratory tests. These screenings can detect certain behaviors, habits, infections and medical problems before they become advanced or serious. The health insurance plan provides you with the opportunity to have regular screenings.

Benefits – Timely detection of a serious, life-threatening condition. May Increased chances of scheduling treatment in a timely manner.

Why it necessary – No one pays attention to health exams when there is no disease. And it does not become known until it’s advanced.